Registry of transparency and final beneficiaries 2021

September 2019 was the beginning of this obligation and then it was decreed that the companies that had complied with the 2019 Declaration would be considered automatically compliant with the 2020 Declaration. Therefore, it is until this month of April that the companies must once again comply with their Ordinary Declaration but this time, the entirety must have presented it no later than the last day of this month.

The Transparency and Ultimate Beneficial Owners Register (hereinafter RTBF) is a digital registry of shareholders and ultimate beneficial owners, which includes four obligated entities: Legal Entities, Trusts, Non-Profit Organizations, and Third-Party Resource Managers. This registry was established to comply with international standards and recommendations (OECD–FATF) regarding tax and financial transparency, aiming to disclose the ultimate beneficial owner of various legal vehicles. It allows the authorities to have current, relevant, and timely information to fight against tax evasion, tax fraud, money laundering, terrorism financing, and other related crimes.

Entities required to provide information in the RTBF system

-

Legal entities registered with the National Registry with valid corporate status, including:

- Corporations (Sociedades Anónimas).

- Limited Liability Companies (Sociedades de Responsabilidad Limitada).

- General Partnerships (Sociedades en Nombre Colectivo).

- Limited Partnerships (Sociedades en Comandita).

- Foreign companies with a Costa Rican corporate ID.

- Individual Limited Liability Companies.

- Civil and Professional Companies.

-

Private trusts, national or foreign, that operate in Costa Rica.

Requirements:

- Possession of a digital signature for individuals.

- Be registered as a user on the BCCR website. https://www.centraldirecto.fi.cr/sitio/CentralDirecto/Inicio/PaginaPrincipal

Authorized persons:

- For legal entities, the legal representative is the designated person to carry out the filing. If joint representation is required, the declarant must have authorization from the other representative to complete the filing in the RTBF. This must be recorded in the service usage agreement as well as in the sworn statement signed when submitting the declaration. Additionally, the filing may be carried out by a single proxy (an individual with sufficient powers), duly authorized in the system through a notary public. If the authorization is granted via a special power, it must be executed in a public deed. These details are regulated under Article 14 of the current Joint Resolution.

- For trusts, the trustee must first appear before a notary public so the trust can be registered in the RTBF system. Based on the trust agreement, the notary will record the trustee’s information and, optionally, appoint a single authorized person. Alternatively, the trustee can later appoint the authorized person once the trust has been registered in the system by the notary public. This procedure is regulated under Article 23 of the current Joint Resolution.

Information to be provided:

- Legal entities registered in the National Registry with valid corporate status must provide details of the total share capital, information identifying all shareholders, and ultimate beneficial owners (direct or indirect), or those who exert substantial influence by other means. See Annex I of the current Joint Resolution for details.

- Private trusts, national or foreign, must provide information on the trust’s purpose, type, economic activity, amount, and identifying details of each party to the trust, as well as any individual who exercises control by other means or receives benefits from the trust, considered ultimate beneficial owners. See Annex II of the current Joint Resolution for details.

Sanctions:

- Financial penalty of 2% of the gross income of the legal or legal structure entity, based on the income tax period prior to the infringement, with a minimum of 3 base salaries and a maximum of 100 base salaries.

- The National Registry will not issue legal entity certificates or register documents for those who fail to provide the required information.

- Notaries must state in the documents they issue that the obligated party is in breach of the Law to Improve the Fight Against Tax Fraud.

Updates in the 2021 declaration:

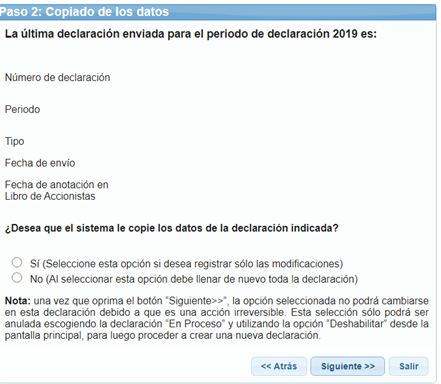

The system allows users to "preload" or "copy" the complete data from the 2019–2020 declaration, greatly facilitating compliance by allowing modifications or simply confirming and submitting.

Frequently Asked Questions

- Where do I file the declaration?

- If a power of attorney was granted for the 2019 filing, is it valid for 2021?

- If the power was granted indefinitely, the proxy may file the Ordinary Declaration for 2021 using the same power. If it has expired, a new power must be granted to the same or another proxy.

- If I establish a company on May 1, do I need to file until 2022?

- A company established after the filing period has 20 business days to submit its first declaration.

- What if I did not file the 2019 declaration, even though the company was already established?

- A one-time flexibility measure applies. The company will appear on a list of non-compliant entities, and no certificates or document registrations will be issued until compliance. A one-time 50% discount on the penalty applies, but from May 2020 onward, full sanctions (3 to 100 base salaries) are enforced. Notaries must also indicate non-compliance in all documents.

- What if my company was established between January 2020 and March 2021?

- As a one-time measure, such companies must file their first declaration in 2021. From then on, all new companies must file within 20 business days of incorporation.

- What if I make mistakes in the filing?

- You may make corrections within one calendar month after the initial declaration by filing a corrective declaration.

- Can my accountant file the declaration?

- The first responsible party is the legal representative(s), but a notarial power of attorney can authorize another person, provided they have a digital signature.

Information extracted and summarized from the Ministry of Finance website.