Changes in VAT on digital platforms and other services!

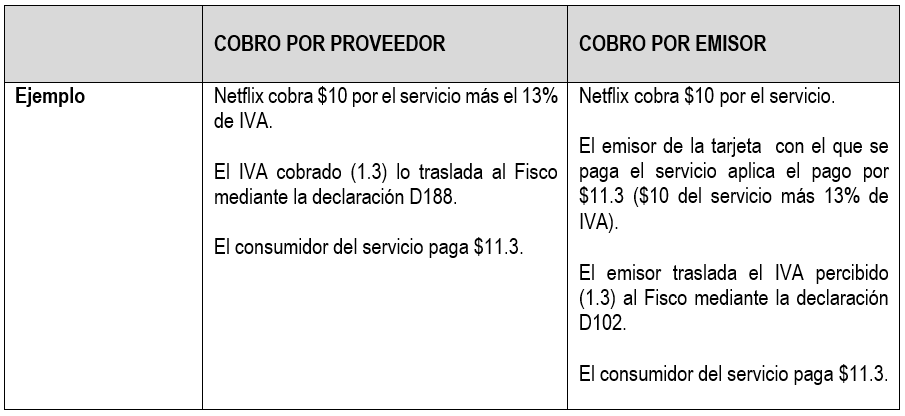

As of August 1, the collection of 13% value added tax will begin on cross-border digital services, in compliance with the provisions of the Value Added Tax Law.

The following is a list of providers and intermediaries whose transactions are subject to VAT withholding when paid through credit cards, debit cards, or other payment methods, since they are not registered as VAT taxpayers in Costa Rica.

- AirBnB

- Apple (+ and Music)

- Dropbox

- Facebk

- HBO

- iTunes

- Microsoft

- Netflix

- Nintendo

- Norton

- Playstation

- Riotgames

- Sky

- Spotify

- Steamgames

The supporting documents for VAT taxpayers regarding these services include purchase invoices issued by foreign-based providers or intermediaries, the bank statement of the card used to pay for the service, and other equivalent documents, provided that the taxpayer appears as the holder of the invoice, account, or service.

This regulation is based on the resolution regarding the collection and withholding of VAT on cross-border digital services. To read the full statement, click on this link to resolution DGT-R-13-2020 from the Ministry of Finance.