Changes in Hacienda: OVI, Tribu CR, TicoFactura and more

For several years, Costa Rica’s Ministry of Finance relied on the ATV system as the central platform for managing taxes and fiscal procedures. However, over time it became insufficient, insecure, and inadequate to meet the growing demands of a country that requires agile, secure, and modern processes for handling public finances. In response to these limitations, the Ministry has promoted a digital transformation that includes new tools such as the Virtual Office (OVI) to centralize procedures and reduce taxpayer bottlenecks, the Tribu CR platform for integrated tax management, customs systems like ATENA to streamline foreign trade, as well as electronic invoicing and transfer services. These innovations aim not only to modernize tax administration, but also to enhance the citizen experience and strengthen fiscal transparency.

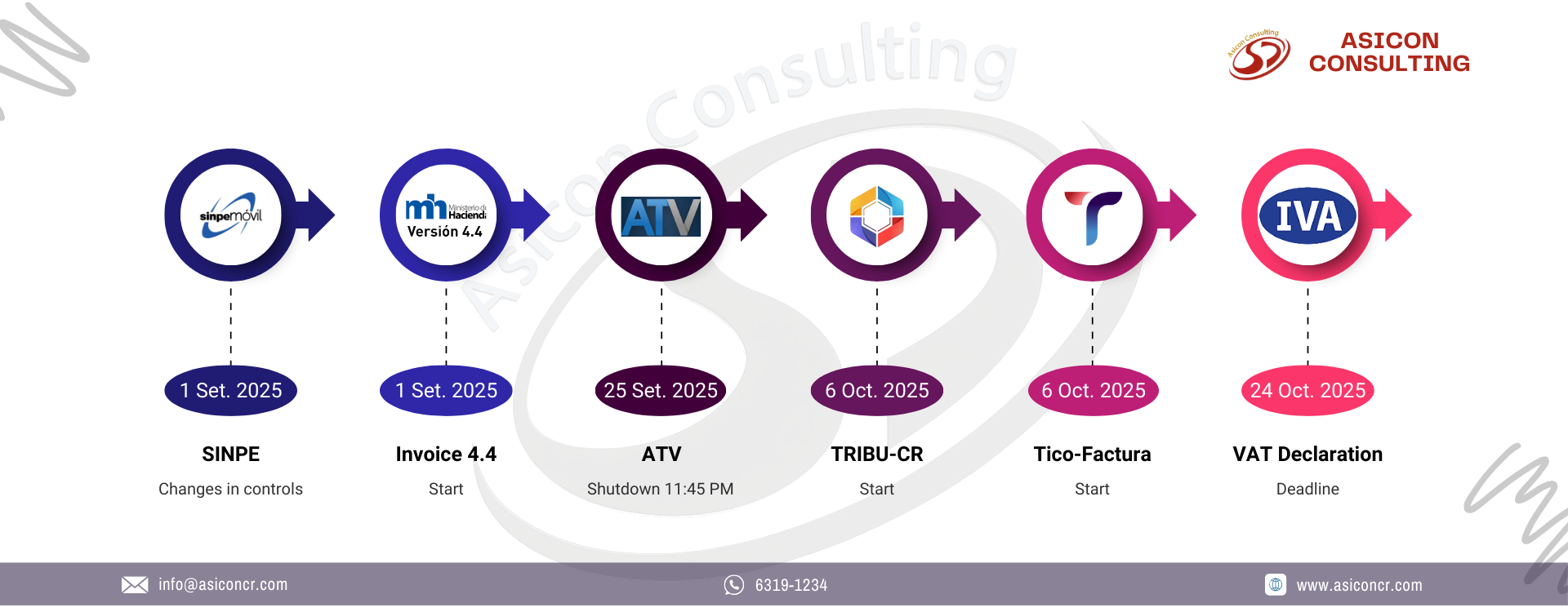

In this context, the Ministry of Finance has defined a roadmap with clear milestones and concrete deadlines for the implementation of new platforms and regulatory adjustments. Among them, the entry into force of version 4.4 of electronic invoicing as of September 1, 2025, which introduces specific codes for payment methods such as SINPE Móvil and other digital solutions; the strengthening of the Virtual Office (OVI) as the single access point for tax procedures; the deployment of Tribu CR as the core of the modern tax system; and the consolidation of complementary tools such as ATENA, for customs management, and TicoFactura, to standardize electronic invoicing. These changes not only establish new standards of traceability and control but also set the foundation for a more efficient, transparent, and modern tax ecosystem aligned with the country’s current needs.

National Electronic Payments System (SINPE Móvil)

Background:

The National Electronic Payments System (SINPE Móvil) has become one of Costa Rica’s leading digital payment methods, moving more than ¢10 trillion in 2024. However, its rapid growth has also revealed risks associated with the use of personal accounts for commercial purposes, which makes tax traceability difficult and creates opportunities for tax evasion. In response, the Ministry of Finance and the Central Bank of Costa Rica (BCCR) have decided to strengthen controls through adjustments in electronic invoicing, without modifying the operational functioning of the platform.

Changes:

- A new code “06” is incorporated in version 4.4 of electronic invoicing to identify payments made through SINPE Móvil.

- Enhanced control against tax evasion and the improper use of personal accounts for commercial purposes.

- Businesses and professionals will be required to properly register the payment method in their electronic receipts.

Implementation date:

The changes will take effect on September 1, 2025. From that date, businesses and independent professionals using SINPE Móvil as a means of payment must ensure that their electronic receipts accurately reflect the method of payment used.

Final notes:

The Central Bank and the General Directorate of Taxation have reiterated that this measure is not intended to penalize users or impose new taxes, but to strengthen transparency and tax control. Taxpayers will be able to continue using SINPE Móvil in the same way as before, but those using personal accounts to receive business payments will need to adapt to the regulation to avoid penalties, which may include retroactive VAT and Income Tax charges, as well as fines of up to 150% of the undeclared amount.

Electronic Invoicing Version 4.4

Background:

Electronic invoicing in Costa Rica has become a fundamental pillar for tax administration, allowing greater control, traceability, and efficiency in tax collection. However, the current system required adjustments to adapt to new economic realities, simplify processes for taxpayers and businesses, and strengthen transaction security. For this reason, the Ministry of Finance announced the implementation of version 4.4 of electronic receipts as part of its modernization plan and as the foundation to feed into the new TRIBU CR system.

Changes:

- Electronic Payment Receipt (R.E.P): new mandatory receipt for State institutions and credit operations, allowing VAT to be recorded at the time of payment.

- New payment methods: inclusion of SINPE Móvil and other options in addition to cash and card.

- Economic activity of the recipient: now required in invoices, purchase invoices, and notes.

- New ID types: categories for “Non-resident foreigners” and “Non-taxpayers.”

- Expansion of sales conditions: more options in addition to cash and credit.

- New VAT classifications: better categorization of taxes.

- XML adjustments: changes in the summary of electronic receipts for greater clarity.

- Creation of bundles or combos: ability to break down products in promotions or bonuses.

- Endorsement signatures in XML: additional layer of security.

- Inclusion of multiple email addresses: up to four per recipient.

- “Other” node: adjustments in additional information fields required by large companies.

- Presumptive declarations: automatic generation of monthly draft returns in TRIBU CR.

Implementation date:

All taxpayers must adopt version 4.4 of electronic invoicing starting on September 1, 2025.

Final notes:

Although many of the changes fall under technical adjustments at the system development level, for end users the operational impact will be limited. The main goal is to strengthen traceability, simplify tax compliance, and facilitate the filing of returns. With this step, the Ministry of Finance seeks to consolidate a more modern, efficient tax ecosystem aligned with the country’s current demands.

Virtual Tax Administration (ATV)

Background:

The Virtual Tax Administration (ATV) has been, for years, the Ministry of Finance’s online platform used to file returns, consult information, and manage tax procedures in Costa Rica. However, its infrastructure has proven limited and vulnerable, recalling incidents such as the hacking that occurred during the pandemic which compromised the security and availability of taxpayer data. In light of this, the Ministry decided to replace ATV with a more modern, secure, and robust platform: TRIBU CR.

Changes:

With the migration, ATV will cease to operate permanently, which means taxpayers must safeguard and download all stored information before the shutdown. The new TRIBU CR system will take on the main role in digital tax management, aiming for greater security, traceability, and efficiency in fulfilling tax obligations.

Implementation date:

The tax shutdown is scheduled for September 25 at 11:45 p.m., at which time a “snapshot” of the taxpayer database will be taken. Subsequently, the TRIBU CR system will officially begin operations on October 6.

Final notes:

Tax experts, such as our director Rolando E. Quirós, recommend that taxpayers back up all information stored in ATV, since once the shutdown occurs, the platform will disappear. This step is essential to avoid the risk of data loss and ensure timely compliance with tax obligations. The transition to TRIBU CR marks a historic change in Costa Rica’s tax administration, establishing new foundations of trust and security in digital tax management.

Tax Administration System (Tribu-CR)

Background:

The Tax Administration System (Tribu-CR) emerges as the Ministry of Finance’s response to the limitations and vulnerabilities of the former ATV platform. For years, taxpayers faced an inflexible, insecure system with complex processes that did not meet the needs of a country seeking to modernize its fiscal management. With the launch of Tribu-CR and its Virtual Taxpayer Office (OVI), a new era of digital tax administration begins, where simplification of procedures, technological integration, and the fight against tax evasion are the fundamental pillars.

Changes:

Among the most relevant elements introduced by Tribu-CR are:

- Complete modernization of tax systems, integrating previously dispersed processes into a single platform.

- Greater ease for taxpayers, with simpler and faster processes for tax filing.

- New way of filing VAT returns, shifting from being regulated by economic activity to being based on tax rates.

- Management and documentation of simplified procedures, reducing time and administrative burden.

- New self-assessed and informative forms, to be filed monthly and annually.

- Stronger government control, allowing more precise identification of tax evasion and avoidance cases.

- Integration with version 4.4 of electronic invoicing, bringing significant changes in payment method registration and receipts.

Implementation date:

The official launch of Tribu-CR and its OVI is scheduled for October 6, 2025. Additionally, in February 2026, thousands of taxpayers will be required to file transfer pricing returns for the first time, marking another milestone in the modernization and control of the country’s tax system.

Final notes:

The launch of Tribu-CR not only involves a technological update but also a comprehensive transformation in how taxpayers and the tax authority interact. It is important to note that there will be no trial period to get acquainted with the platform, so taxpayers are advised to seek specialized guidance and prepare in advance to properly meet the new requirements. Beyond the economic and technical challenges this transition entails, Tribu-CR represents a decisive effort to strengthen transparency, reduce evasion, and position Costa Rica at the forefront of digital tax administration.

Virtual Tax Office (OVI)

Background:

The Virtual Taxpayer Office (OVI) is the new digital access point that the Ministry of Finance makes available to individuals and legal entities as part of the Tribu-CR platform. It is designed to progressively replace the old ATV and centralize in a single portal tax management, filing of returns, receipt of notifications, and consultation of the integrated tax account. Its implementation is key to ensuring information security and modernizing the relationship between the Tax Administration and taxpayers.

Changes:

With OVI, taxpayers must:

- Create a new username and password, linked to the updated physical or legal ID card.

- Validate their identity with the security code included in the most recent ID cards.

- Validate the migration of their basic information from ATV, with direct access to Tribu-CR.

- Familiarize themselves with the platform, exploring functions such as filing returns, electronic notifications, and account status inquiries.

- Verify pre-filled data in returns based on electronic invoicing, comparing them with their own accounting records.

- Keep information updated in the Taxpayer Registry (RUT): address, economic activity, legal representatives, and other relevant data.

- Adopt version 4.4 of electronic invoicing, ensuring information flows correctly to the Ministry of Finance.

Implementation date:

Access to OVI will be enabled starting October 6, 2025, coinciding with the official launch of Tribu-CR. From that date, taxpayers will need to register and begin using the new platform, as it will be the central point for tax management.

Final notes:

OVI represents a profound change in the way taxpayers interact with the Ministry of Finance. Although there will be no trial period, the Ministry will provide guides and training sessions to facilitate the transition. It is essential for taxpayers to prepare in advance, back up their information, validate their accounting records, and adapt to the new digital environment. Keeping information up-to-date and making the most of OVI’s tools will ensure a smoother transition, reduce errors, and strengthen transparency in tax compliance.

Free Billing System (Tico-Factura)

Background:

As part of the Hacienda Digital strategy, the Ministry of Finance will introduce a new free billing system called “Tico-Factura,” managed by the General Directorate of Taxation and replacing the current Hacienda billing system. This tool arises from the need to provide a universal, accessible, and free solution for all taxpayers to comply with their fiscal obligations. Decree No. 44739-H, published on November 8, 2024, establishes its regulation under the Electronic Invoice Regulation, as part of the ecosystem aimed at modernizing the country’s tax administration.

Changes:

With the implementation of Tico-Factura:

- All taxpayers will have access to a free billing system, without sectoral restrictions.

- The system will function as an official alternative alongside other private solutions on the market, without limiting their use.

- The obligation to issue electronic invoices for all sales of goods or services is reaffirmed.

- Two authorized types of documents remain in force:

- Electronic Invoice, valid as support for deductible expenses and credits between taxpayers.

- Electronic Ticket, aimed at end consumers who do not require accounting support.

- Both documents must be sent to the General Directorate of Taxation for validation and control.

Implementation date:

The rollout of Tico-Factura is scheduled within the Hacienda Digital roadmap starting October 6, 2025, in line with the deployment of Tribu-CR and the OVI. Its availability will be continuous and free for any taxpayer who wishes to use it.

Final notes:

The General Directorate of Taxation has reiterated that the goal of Tico-Factura is to facilitate tax compliance and simplify the filing process. It has also denied claims from some private companies suggesting that this billing tool would be limited to certain sectors. With this launch, Hacienda seeks to ensure that all taxpayers, regardless of their size or industry, have access to an official, reliable, and free tool that strengthens traceability and fiscal control.

The implementation of Hacienda Digital, with the launch of TRIBU-CR, the OVI, TicoFactura, and version 4.4 of electronic invoicing, marks a groundbreaking milestone in the modernization of Costa Rica’s tax system. These changes aim not only to optimize tax management processes but also to provide greater security, transparency, and traceability to all transactions.

As part of this adaptation process, the Ministry of Finance has confirmed that the deadline for filing the VAT return corresponding to September will be extended until October 24, 2025. This extension is intended to give taxpayers the necessary time to become familiar with the new platforms and ensure that data is processed correctly.

With this measure, Hacienda demonstrates its commitment to supporting the transition toward a more efficient digital tax ecosystem, while addressing the realities and challenges faced by taxpayers.

At Asicon Consulting, we provide a team of specialists in taxes, accounting, technological integrations, and fiscal advisory, ready to support your company in properly adapting to the new Hacienda Digital platforms. Our commitment is to deliver practical, tailored solutions that guarantee regulatory compliance and enhance your organization’s tax management.

We invite you to contact us through the Contact Us section at the end of this article and to follow us on our social media and official WhatsApp channels, where we share news, updates, and valuable articles designed to support your SME on its digital transformation journey.