Changes in CCSS Contributions for 2026: A Quick Guide for Employers

Starting January 1, 2026, a new adjustment to the worker–employer contribution rates of the Costa Rican Social Security Fund (CCSS) will come into effect. This update is part of a gradual process aimed at strengthening the stability of the Disability, Old-Age, and Death (IVM) regime. The increase responds to the need to ensure the long-term sustainability of the pension system in a national context where the active working population has been decreasing relative to the number of retirees or individuals nearing retirement. Given this scenario, the CCSS has implemented a staggered scheme of increases to strengthen the fund’s revenues without creating an abrupt impact on labor costs.

For businesses, this change requires a careful review of payroll cost structures, particularly at a key time of year when many organizations are preparing for fiscal year-end and budget planning for the upcoming period. Anticipating the financial impact of the adjustment will enable more accurate projections, the definition of compensation strategies aligned with current regulations, and the assurance of compliance with employer obligations without disrupting operations. Likewise, for workers, this adjustment entails a slight variation in the mandatory contribution, which will result in minimal changes to net salary. In both cases, understanding the nature and scope of the change is essential for sound financial and administrative decision-making.

Reason for the change

The worker–employer contribution rate is being modified due to the need to strengthen the financial sustainability of the Disability, Old-Age and Death (IVM) insurance regime administered by the CCSS. Costa Rica is experiencing a decline in the active workforce and an increase in the number of retirees, which places pressure on the pension system. To ensure the fund can meet its future obligations without compromising its long-term stability, the CCSS implemented a gradual adjustment in contributions that will take effect as of January 2026.

Specifically, what is changing?

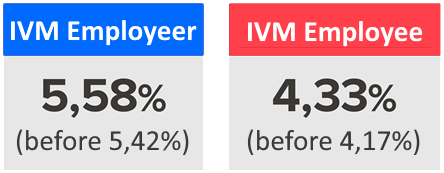

The adjustment announced by the CCSS for the year 2026 applies exclusively to the contributions for the Disability, Old-Age and Death (IVM) insurance:

- A total increase of 0.32 percentage points will be applied to IVM contributions.

- Employer contribution to IVM: increases from 5.42% to 5.58% → a rise of 0.16 pp.

- Worker contribution to IVM: increases from 4.17% to 4.33% → a rise of 0.16 pp.

- This adjustment is part of the gradual plan implemented by the CCSS to reinforce the sustainability of the pension regime.

-

- The remaining components of the social security burden maintain their current rates:

- SEM, FODESAF, IMAS, INA, Banco Popular, FCL, Complementary Pension Funds.

- Workers’ Compensation Insurance maintains its structure, except for variations in premiums based on economic activity.

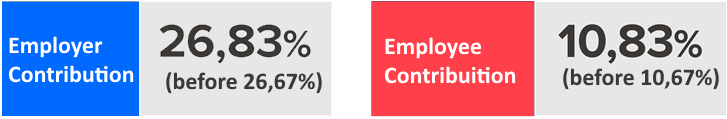

Impact on total Social Security contributions

Overall, the adjustment to the IVM contribution results in direct variations to the total percentage of social security contributions made by both employers and workers:

- Total employer contribution (companies):

- 2025: 26.67%

- 2026: 26.83%

- Total worker contribution:

- 2025: 10.67%

- 2026: 10.83%

- The increase corresponds exclusively to the adjustment in the Disability, Old-Age and Death (IVM) insurance.

-

- In practice, this means:

- A slight increase in labor costs for companies due to the higher employer contribution.

- A minor reduction in net salary for workers as a result of the increased IVM deduction.

Breakdown of Social Security contributions 2025 vs 2026

The following table presents the detailed structure of social security contributions for the years 2025 and 2026. All items maintain their existing rates except for Disability, Old-Age and Death (IVM) insurance, which is the only component that changes in 2026 due to the gradual adjustment approved by the CCSS to strengthen the pension system's sustainability. Although the change in IVM is relatively small, it has a direct impact on labor costs for companies and mandatory contributions from workers.

| Employer Contributions | 2025 | 2026 | Δ pp |

|---|---|---|---|

| CCSS – SEM (Sickness and Maternity) | 9.25% | 9.25% | 0.00% |

| CCSS – IVM (Disability, Old-Age and Death) | 5.42% | 5.58% | 0.16% |

| FODESAF (Family Allowances) | 5.00% | 5.00% | 0.00% |

| IMAS | 0.50% | 0.50% | 0.00% |

| *INA (non-agricultural, ≥5 employees) | 1.50% | 1.50% | 0.00% |

| Banco Popular (employer quota collected by CCSS) | 0.25% | 0.25% | 0.00% |

| LPT – Banco Popular | 0.25% | 0.25% | 0.00% |

| LPT – FCL (Labor Capitalization Fund) | 1.50% | 1.50% | 0.00% |

| LPT – Complementary Pension Fund | 2.00% | 2.00% | 0.00% |

| **INS – Workers’ Compensation Insurance | 1.00% | 1.00% | 0.00% |

| TOTAL EMPLOYER | 26.67% | 26.83% | 0.16% |

(*) Non-agricultural employers with fewer than 5 permanent workers do not pay the INA contribution (1.50%). Total social security costs therefore change from approximately 25.17% (2025) to 25.33% (2026).

(**) Reference rate. Actual Workers’ Compensation premiums vary by economic activity and risk class.

| Worker Contributions | 2025 | 2026 | Δ pp |

|---|---|---|---|

| CCSS – SEM | 5.50% | 5.50% | 0.00% |

| CCSS – IVM | 4.17% | 4.33% | 0.16% |

| Banco Popular – worker contribution | 1.00% | 1.00% | 0.00% |

| TOTAL WORKER | 10.67% | 10.83% | 0.16% |

Recommendations for companies

With the upcoming implementation of the 2026 adjustment to social security contributions, it is essential for organizations to prepare in advance to ensure proper compliance with the new requirements. Below are key actions recommended for a smooth transition:

- Review and update the 2026 payroll budget, incorporating the increase resulting from the new IVM contribution rate.

- Verify and adjust payroll system parameters so that the first payment of January 2026 correctly reflects the updated contribution rates.

- Communicate the changes to employees in advance, explaining how the adjustment will affect deductions and net salary during the first pay period of 2026.

How can Asicon Consulting support you?

At Asicon Consulting Costa Rica, we have a specialized team in payroll management, social security compliance, and labor obligations. We support your organization in the proper implementation of these changes through comprehensive services, including:

At Asicon Consulting, we help companies maintain full compliance with current labor and social security regulations. If you would like more information about our services or require specialized assistance, we are here to support you.